Stan Uryasev (University of Florida, USA)

Risk Management with POE, VaR, CVaR, and bPOE: Applications in Finance

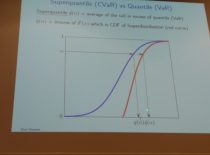

This paper compares four closely related probabilistic measures: Probability of Exceedance (POE), Value-at-Risk (VaR) which is a quantile, Conditional Value-at-Risk (CVaR), and Buffered Probability of Exceedance (bPOE).

The Probability of Exceedance (POE) is frequently used to measure uncertainties in outcomes. For instance, POE is used to estimate probability that assets of a company fall below liabilities. POE measures only the frequency of outcomes and ignores magnitude of outcomes. POE counts outcomes exceeds the threshold, and it “does not worry” about the amount by which each outcome exceeds the threshold. POE is lumping together all threshold exceedance events, potentially “hiding” quite large and very troublesome outcomes. Moreover, POE has poor mathematical properties when used to characterize discrete distributions of random values (e.g., when distributions are defined by observed historical data). POE for discrete distributions is a discontinuous function of control variables, making it difficult to analyze and optimize. POE is used for defining financial ratings of companies and financial derivative instruments (such as CDO).

This presentation discusses a new probabilistic characteristic called Buffered Probability of Exceedance (bPOE). With bPOE, it is possible to count outcomes close to a threshold value, rather than only outcomes exceeding the threshold. To be more precise, bPOE counts tail outcomes averaging to some specific threshold value. For instance, 4% of land-falling hurricanes in US have cumulative damage exceeding $50 billion (i.e., POE = 0.04 for threshold=$50 billion). It is estimated, that the average damage from the worst 10% of hurricanes is $50 billion. In terms of bPOE, we say bPOE=0.1 for threshold=$50 billion. bPOE shows that largest damages having magnitude around $50 billion have frequency 10%. bPOE can be considered as an important supplement to POE. We think that bPOE should be routinely calculated together with POE. This example shows that bPOE exceeds POE, which is why it is called Buffered Probability of Exceedance. The positive difference, bPOE-POE, can be interpreted as some “buffer.” bPOE is an inverse function of CVaR and it inherits a majority of the exceptional mathematical properties of CVaR (which is a so called “coherent measure of risk”). Similar to CVaR, minimization of bPOE can be reduced to convex and Linear Programming.

We will discuss two applications of bPOE concept. The first application discusses the possibility of redefining financial ratings using bPOE concept. The second application considers the Cash Matching Problem of a Bond Portfolio.

Co-author: Giorgi Pertaia

More about Stan Uryasev

This conference #ewgcfm2018 brings together scientific experts on financial modelling, statistics and economics, decision-making analysis and methods, FinTech and Blockchain, LittleData to BigData in finance and investment, game theory and mathematical economics, banking, insurance, pension planning, pricing and hedging of derivatives, credit and systemic risk, application of OR methods in finance etc.

This conference #ewgcfm2018 brings together scientific experts on financial modelling, statistics and economics, decision-making analysis and methods, FinTech and Blockchain, LittleData to BigData in finance and investment, game theory and mathematical economics, banking, insurance, pension planning, pricing and hedging of derivatives, credit and systemic risk, application of OR methods in finance etc.